Rates was ascending in earlier times 12 months – to your credit cards, mortgages, and other financial products such as for instance house collateral finance and you can home equity credit lines .

Still, that doesn’t mean these things is fundamentally crappy records nowadays. Actually, for the majority of residents, taking out fully a home equity financing these days could possibly getting a sensible flow.

So is this a good time to get property equity loan? Experts weigh-in

Some tips about what advantages must say on whether or not this is basically the right time to obtain a property guarantee loan.

Yes… because the domestic collateral has most likely maxed out

“If you have possessed your property for many decades and its worthy of has grown because your buy, your likely have mainly based-right up collateral,” states Hazel Secco, chairman from Line-up Financial Selection when you look at the Hoboken, Letter.J. “This enhanced household worthy of provides a substantial base to have securing an effective house guarantee financing.”

Nonetheless, that larger amount regarding security may not last for a lot of time. With high home loan costs moving down customer request, home prices – and, from the expansion, home guarantee – you can expect to slip, as well. It means you’d want to operate in the future when planning on taking advantage of your security on its fullest.

“For someone seeking to faucet house security, now could be an enjoyable experience to look involved with it, considering the fact that home values will can you take out a wedding loan most likely not score best toward foreseeable future,” claims Michael Micheletti, master profit manager at your home equity trader Discover.

House collateral finance commonly sensible in the event the you will have to promote our house in the future, because if your property falls inside the worth ranging from now and then, it might “cause a posture known as are under water,” Secco says, “where in actuality the outstanding mortgage harmony exceeds this new residence’s market worthy of.”

If you find yourself under water on your financial, offering your residence wouldn’t internet you adequate to pay your own fund, and you will become owing your mortgage lenders into the leftover outstanding stability.

In the event that all you need to pay getting – home fixes, scientific costs, or any other bills – are unavoidable and you can perform if you don’t embark on credit cards, personal loan, or another style of high-interest loans, property guarantee mortgage could be a better choice. Because Secco sets they, “Most other loan interest rates commonly very enticing at this time.”

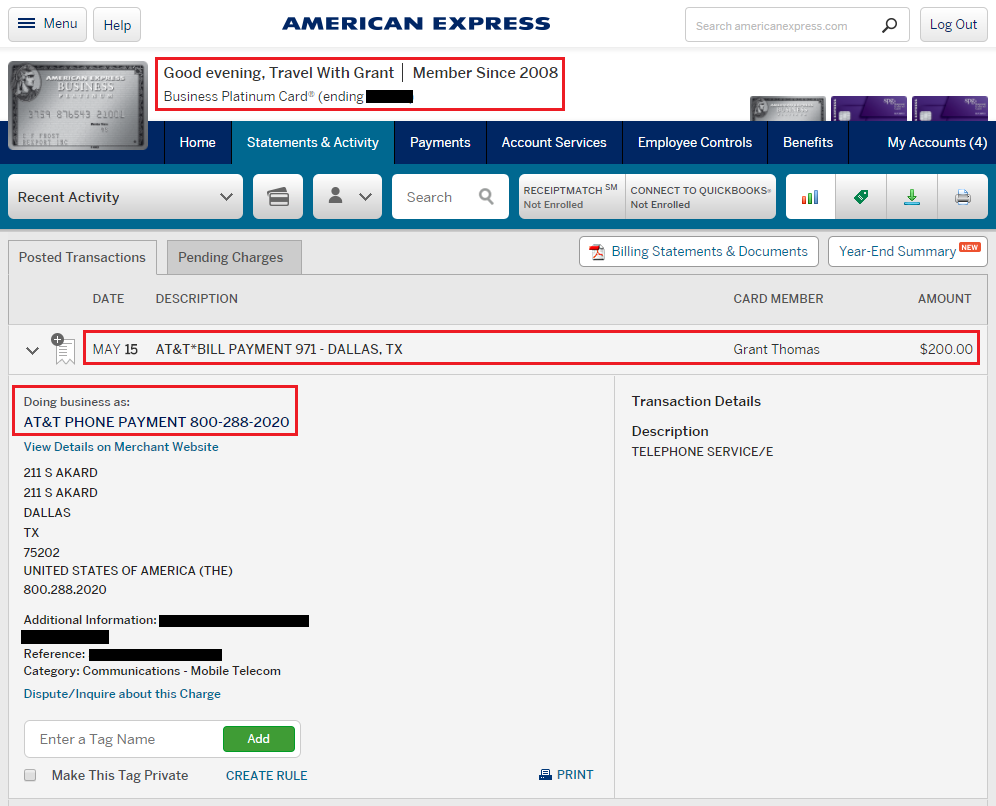

She is proper: An average charge card rate is over 21% at this time, compared to the 8 so you can ten% you will find toward a house security loan. Consumer loan rates keeps topped several%.

“It’s the so much more financially beneficial choice than the taking right out an effective consumer loan otherwise relying on credit card borrowing from the bank,” Secco claims.

Zero… if your credit’s maybe not higher

Just as in really lending products, your credit score plays a massive character inside not simply qualifying to own property equity mortgage – exactly what rate of interest you have made on a single, as well. And if your credit rating is actually reduced, you’re likely to score a higher level (and you can then, a premier payment per month, too).

“If someone’s credit does not be considered them to discover the best rates, costs are going to be way too high into the homeowner’s funds,” Micheletti states. “We are viewing most credit toning today, also, making it harder getting people to be eligible for loan services to find the best rates.”

You could potentially constantly look at the rating via your lender otherwise credit card issuer. To get the reasonable cost, you will generally want a beneficial 760 credit history or higher.

Sure… when you yourself have a good amount of highest-interest personal debt

Given that household security money enjoys straight down interest levels than other monetary circumstances, they are able to continually be recommended to have merging obligations. Should you have $ten,000 into a credit card with a 21% price, such as for instance, using an enthusiastic 8% home security loan to repay you to balance can save you a tremendous amount in attention will cost you.

Credit card pricing was adjustable, also, which means your rates and you may costs can also be go up. Family equity loans never come with this chance.

“Family guarantee funds provide repaired interest rates,” Micheletti says, “to make sure home owners the price cannot go up inside label off the mortgage.”

No… in case the income is volatile

Fundamentally, if you have unstable income and you can are not yes you can easily accept a moment monthly payment, a house equity mortgage most likely is not necessarily the most useful disperse.

Since the Micheletti sets they, “There is a risk of placing their residence toward foreclosure if they skip money on mortgage.”

Comparison shop for your house guarantee mortgage

You can buy property security loan otherwise HELOC out of many banks, borrowing from the bank unions and you can mortgage brokers. To ensure you’re going to get an informed speed , usually contrast at least a few options.

Look at fees and you may closing costs, too, and start to become careful to only use what you would like. Credit continuously can lead to needlessly high repayments, hence develops your own threat of property foreclosure.